Less than 5 years ago, mobile apps were all the rage. Everyone and their brother dove into the business churning out gaming apps, utility apps, social apps – you name it! The impetus has been the rise of the smart phone which now has over 1.6 billion users globally, effectively surpassing desktop usage. What’s more, 86% of the user’s time spent is on mobile apps vs. 14% on the mobile web.

It’s clear that apps are dominating usage. However, the over-abundance of apps has also splintered the usage time spent on each application, rendering many of the apps inactive.

For QSRs and retailers developing mobile marketing initiatives to activate their customers and build out loyalty programs, this fragmentation is worrisome. In a sea of increasing mobile app volume, how do these businesses enable their customers to keep the brand top-of-mind, especially as mobile activity becomes the standard?

Digital Wallets, while still fairly nascent, have emerged as a viable alternative especially as mobile payments gains more traction. In our recent post, we noted,

Digital wallets are gaining in popularity. According to stats, 25% of boarding passes are currently saved on PassBook; because Apple’s iPhone owns only 40% of the market, this tells you how significant the growth of digital wallets are. People are starting to store more and more of their passes, cards, and tickets in PassBook. We believe that In 5 years, most people won’t carry physical cards and wallets; using their digital wallet to store these things will make their lives easier and give them protection from theft.

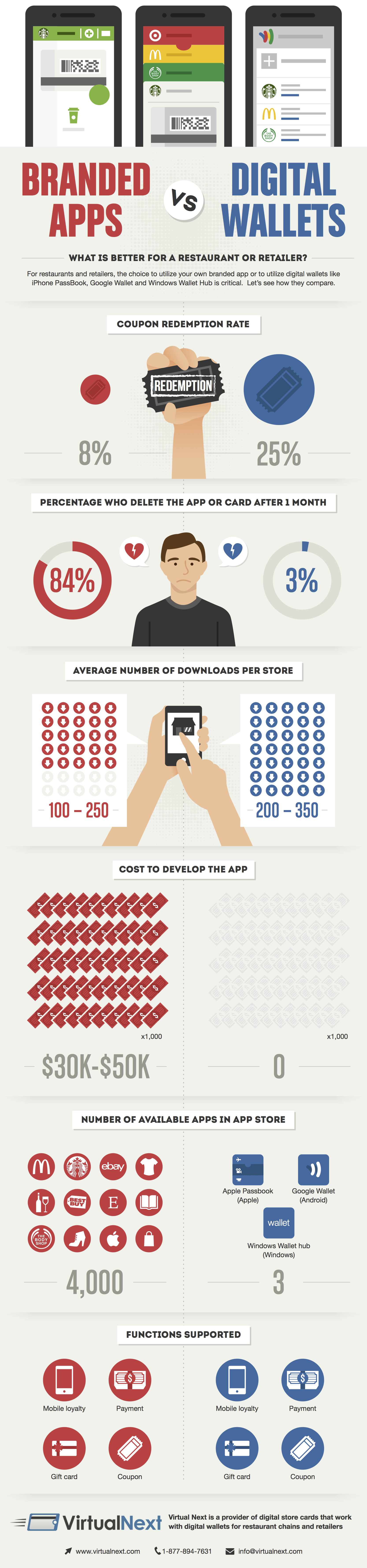

We did our research and weighed the pros and cons between branded apps and digital wallets for restauranteurs and retailers. Check it out! We’d love to know your thoughts.